When you think about the term “financial independence” what comes to mind? A young woman entering the real world for the first time and cutting financial ties with her parents? A woman leaving a relationship and figuring out her finances on her own?

It might be the word “independent” that trips us up because that conjures up images of someone being on their own. However, being independent doesn’t mean being solitary. It means being in control.

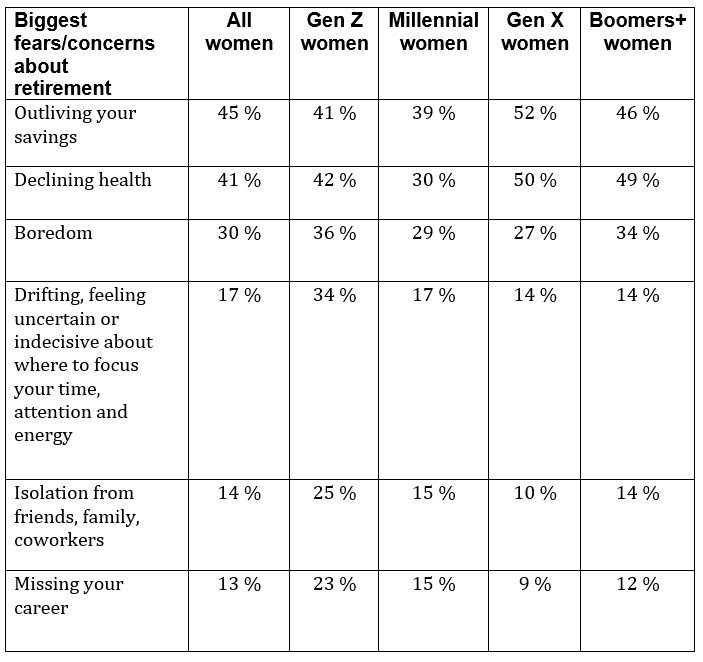

In a recent study by Bank of America, they asked women about how they perceive financial independence. Here are some of the results:

When it comes to banking, women having their own bank account independent of their partners is on the rise. According to Statista, almost 51% of women in the United States had bank accounts separate from their partners in 2020. This doesn’t mean that they might not have had joint accounts as well – but knowing that you have your own source of funds can be a motivator and a confidence booster.

First off, let's clear something up—financial independence doesn't mean you have to do everything solo or cut ties with your partner. It's about having your own financial footing, regardless of your relationship status. Whether you're in a long-term partnership, casually dating, or flying solo, having control over your finances is empowering.

It’s also about having the freedom to call the shots when it comes to your money. It means you don't have to rely on anyone else to pay your bills, fund your dreams, or secure your future. And let me tell you, that's a kind of freedom that feels like winning the lottery every darn day.

First things first: it's time to get cozy with your finances. I'm talking about getting down and dirty with your budget, tracking your spending, and knowing exactly where your money is going. It might not sound like a party, but trust me, it's the first step on the road to financial freedom.

Next up, let's talk about hustling. Whether you're climbing the career ladder, side-hustling like a boss, or starting your own empire, having your own source of income is non-negotiable. It's not just about making ends meet; it's about building a life that's full of possibility and adventure.

And the best part? Setting your own goals. Whether it's buying a home, traveling the world, or retiring early and sipping margaritas on a beach somewhere, having clear financial goals can keep you focused and motivated along the way. Plus, there's nothing more satisfying than crushing those goals; that goes a long way in cementing your financial confidence.

Regardless of your relationship status, financial independence isn't just about money; it's about power. It's about having the power to say yes to the things that light you up and no to the things that don't. It's about having the power to walk away from toxic situations and build a life that's authentically yours.

It's also about freedom. It's about having the freedom to make choices that align with your values, goals, and dreams. It's about having the confidence to stand on your own two feet, no matter what life throws your way.

Are you ready to take the next steps toward financial independence? Let’s talk.

That uncomfortable moment when you want to say no, but you’re worried it will upset someone else. Or when you agree to do something even though your gut tells you that you’d rather do just about anything else. Maybe even a time when you’ve been in an uncomfortable intimate situation, but you let it happen because you didn’t want the other person to get mad.

If any of these scenarios resonate with you, you might be a people pleaser.

What is a People Pleaser?

Being a people pleaser refers to someone who prioritizes the needs and desires of others over their own, often at the expense of their own well-being. People pleasers typically go to great lengths to avoid conflict, seek approval, and ensure that those around them are happy and satisfied.

They may have difficulty saying no, setting boundaries, or asserting themselves in order to avoid disappointing or upsetting others. This behavior can stem from a desire for acceptance, fear of rejection, or low self-esteem. While being considerate and accommodating can be positive traits, being a chronic people pleaser can lead to feelings of resentment, burnout, and a lack of fulfillment in one's personal and professional life.

Unfortunately, but not surprisingly, women make up the majority of people pleasers. According to YouGov, “Women (56%) are more likely than men (42%) to say they would describe themselves this way.”

Psychology Today has this to say about WHY more women tend to fall into this category”

Women are largely humanity’s caretakers, and they are taught to be more passive, less aggressive; plus, a people-pleasing woman will not likely be labeled high maintenance or “difficult.” She would rather bend over backward than appear fussy.

There are countless articles about how people pleasing can affect you (and your self-esteem). But what if I told you that it’s affecting your wallet as well?

Overcommitting: People pleasers often have difficulty saying no to requests for help or favors, even if it means taking on too much work or responsibilities. This can lead to overcommitment, causing you to spend time and resources on tasks that aren't directly beneficial to your financial goals.

Undercharging for services: People pleasers may undervalue their own skills and abilities, leading them to undercharge for their services or products. They may feel uncomfortable negotiating rates or asking for what they're worth, which can result in lost income opportunities.

Difficulty in negotiation: Negotiation is an essential skill in many financial transactions, whether it's negotiating a salary, contract terms, or prices for goods and services. People pleasers often struggle with assertiveness in these situations, making it harder for them to secure favorable terms and deals.

Overspending: People pleasers may feel pressure to keep up with others' expectations or maintain a certain image, leading them to overspend on gifts, outings, or other expenses to please others. This can strain their finances and lead to debt or financial instability.

Lack of boundaries: People pleasers often have difficulty setting boundaries, whether it's with friends, family, or colleagues. This can result in being taken advantage of financially, such as constantly lending money without repayment or being asked to cover expenses for others.

Career stagnation: In the workplace, people pleasers may prioritize harmony and avoiding conflict over advocating for their own advancement or seeking out opportunities for growth. This can lead to being passed over for promotions or raises, ultimately impacting their long-term earning potential.

Cutting the people-pleasing cord isn’t easy and it takes practice to overcome a lifelong habit like this. Here are some quick ideas to help get you started.

Before you say yes to something, take a beat. For example, tell the other person you need to check your calendar and you’ll get back to them. That gives you time to evaluate whether or not you want to do what they’re asking and craft a response.

Identify your patterns: Reflect on situations where you tend to prioritize others' needs over your own. Notice any recurring patterns or behaviors that indicate people-pleasing tendencies.

Practice assertiveness: Communicate your thoughts, feelings, and preferences assertively, without being aggressive or passive. Use "I" statements to express yourself clearly and respectfully.

Learn to tolerate discomfort: Accept that setting boundaries and saying no may feel uncomfortable at first, but it's essential for your well-being. Embrace the discomfort as part of the growth process.

Seek support: Surround yourself with understanding and supportive individuals who respect your boundaries and encourage your growth. Consider talking to a therapist or joining a support group to explore underlying issues and develop healthier habits.

And talk to your financial advisor! If you’re finding that people pleasing is affecting your bottom line, it’s okay to use the excuse, “My financial planner has advised me not to do _____.” Remember that we’re in your corner and part of your support system. We can help you exercise your “no” muscle.

When it comes to finances, a lot depends on the financial narratives we tell ourselves. In fact, there are some myths out there that could be holding many of us back (or at least giving us the excuse to not move forward).

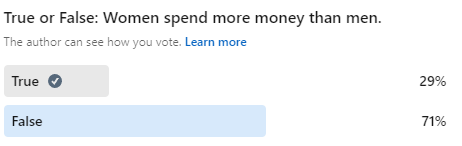

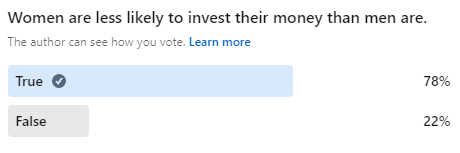

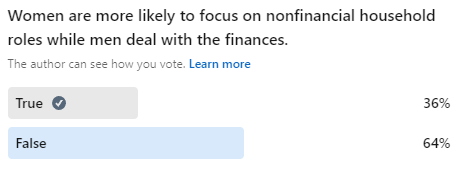

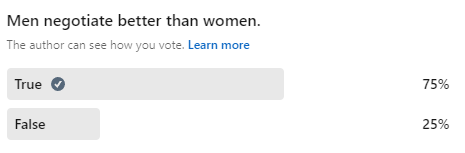

I took to LinkedIn and posted a series of polls to see what the feedback would be on some pretty common money assumptions. Here are the results…and here are the answers.

The majority were right!

According to Directions Credit Union, “Single men outspent single women. Men spent an average of $41,203 a year as opposed to $38,838 by women. It’s important to note, though, that the median earning data from the Census Current Population Survey found that overall, women are paid about 17% less than men.”

So, why do some people think that women spend more? The Fem Word had this to say:

“…a lot of it has to do with popular media. Movies have long depicted female “shopaholics” as main or major characters. The archetypal “rich girl” or heiress is also ubiquitous in Hollywood, and jet-setting celebrities such as the Kardashian sisters or Paris Hilton have only reinforced the image in our popular imagination.”

In other words, don’t believe everything you see in the media. And keep working on getting that pay raise.

The majority got it right again!

Unfortunately, this statistic is true. “While more than half of Americans (56%) say they currently invest in the stock market, this is only true for 48% of women, compared to 66% of men, according to a new NerdWallet survey.”

HOWEVER, it’s important to note that according to Fidelity’s 2021 Women and Investing Study, women’s returns were 0.4% higher than men’s.

Another interesting statistic from the same study: Eighty-six percent of women agree that having their investments managed by professionals makes life less stressful.

Bottom line: Get started, take control of your finances, and ask a professional to help.

This one was interesting because “nonfinancial household roles” can have a big impact on family finances.

According to the Federal Reserve…

Marketing polls and survey data indicate that American women have a large role in consumption decisions undertaken by the typical household in today's consumer markets. As household managers, women supervise the budget for and purchase of many of the highest-cost items consumed by American families. These items include food, clothing, childcare, eldercare, health care, transportation, family communication networks (including cell phone and computer purchases), vacations, and, finally, financial services and products.

One recent market survey reports that women account for 80 percent of all consumer purchasing decisions, making 93 percent of food purchases and 65 percent of auto purchases, for example.6 Because women engage in more of the family shopping, they are more consistently aware of price changes and inflation. Women running households know just what it takes to make the budget stretch and how to navigate changing market prices, and they are engaged in more financial and consumer decision-making than at any other time in our social history.

In other words, as most women still take on primary caregiving duties (along with a ton of other stuff), they’re pretty much running the financial show at home as well.

Sorry, majority. This one is FALSE. It just feels true. And here’s why:

New research by Berkeley Haas Professor Laura Kray shows the belief that women don’t ask for higher pay is not only outdated, but it may be hurting pay equity efforts. Contrary to popular belief, professional women now report negotiating their salaries more often than men, but they get turned down more often, Kray found.

“While men in the past may have been more likely than women to negotiate, the gender difference has since reversed,” says Kray, the Ned and Carol Spieker Chair in Leadership. “Continuing to put the blame on women for not negotiating away the gender pay gap does double damage, perpetuating gender stereotypes and weakening efforts to fight them.

If people believe men have better outcomes simply because they negotiate and women don’t, then they think we just need to train women to negotiate better rather than fixing a discriminatory system,” Kray says. “We call this a ‘legitimizing myth.’”

Let’s just call this what it is: it’s victim shaming. The narrative is that women don’t negotiate as well as men, when the truth is that it’s the system that’s stacked against us. Yes, we’re slowly seeing change, but it can’t come soon enough.

Keep asking for those raises.

When it comes to limiting beliefs about money, a lot of them are ingrained in us because of what society tells us. We have been groomed to believe that we’re not as savvy and we don’t have the same skills as men when in reality women wear so many hats…why WOULDN’T we be better with money than men?

It’s all about overcoming those stereotypes and not giving false narratives the attention they want. Invest, budget, and negotiate and you’ll likely get the outcome you’re looking for.

Ready to be one of those 86% of women who are less stressed because they work with an advisor? Let’s talk.

I don’t know about you, but the world of healthcare has just gotten more and more confusing to me. Looking at benefit options each year is like trying to decipher a secret language; sometimes it’s hard to even ask questions because I don’t know what to ask.

Unfortunately, as a woman, I know that I need to stay on top of things.

Now, the point of this article is not to bag on a lot of the hardworking doctors that are out there; after all, it IS talked about as the “practice” of medicine.

The issue lies in how women are often dismissed when it comes to their health.

If you’ve ever taken a high school English class, you’ve likely read historical narratives where women were diagnosed as “hysterical” and thrown in some dark, damp asylum somewhere. And while we’re less likely to have our spouses throw us in the clink because they found a wench that pours a better pint, the stigma is still there.

Here are a few stories from The Washington Post:

Now more than ever you need to listen to yourself when it comes to better healthcare services. Here are a few things to consider:

Assemble a rockstar squad of healthcare providers. Find professionals who listen, respect your concerns, and treat you like the VIP you are. Don't settle for a healthcare provider who dismisses your questions or rushes through appointments. You deserve someone who values your input.

Also, consider bringing a trusted friend or family member with you to appointments. Having a second pair of ears listening to your doctor and asking questions might help you avoid catastrophic situations.

If something doesn't feel right, trust your gut. You know your body better than anyone. Don't hesitate to seek a second opinion if you're unsure about a diagnosis or treatment plan. Your peace of mind is non-negotiable.

Keep all your health-related documents organized – from medical records to insurance information. Having everything at your fingertips is a game-changer. Familiarize yourself with your insurance coverage. Knowing what's covered can save you from unexpected financial surprises. And investigate using a benefits broker to help you decipher this confusing language; it’s a service that’s free to you and can be invaluable.

“Millennial women’s health and especially mental health are at an all-time low. Seventy-seven percent told us, “It is clear to me that I am the only advocate for my health and well-being.” Why? Fifty-seven percent said “I have been dismissed or misdiagnosed by medical professionals,” and 59% said, “I have sought treatment from doctors who do not believe me, or who have ignored my needs.” Three in four told us they are concerned about their female friends’ mental health “after we have all been through so much.”

Join online communities or support groups for women's health. It's like having a virtual squad to share experiences, tips, and advice. Attend women's health events or workshops. Knowledge-sharing is a two-way street, and you might discover new insights.

Why am I talking about this on a financial planning blog? Being an advocate for your health can have a huge impact on your finances AND having an advisor you’re comfortable with should be part of your support system. We’re not only here to help you look at your money, but all the facets of what can give you the future you want. We can also provide you with resources should you need them.

Ready to take control? Let’s talk.

For many Gen X women, planning for their financial future might take a backseat to other priorities. Between juggling careers, raising children, caring for aging parents, and keeping up with daily life, it's no wonder that many Gen X women do not have a financial plan.

However, it’s pretty obvious that they should. According to a 2023 study from Northwestern Mutual, outliving your savings is the top concern for Gen X women.

If you watch the news or even have a small interest in what’s going on in the world, it’s possible that you feel overwhelmed when you hear about what the market is doing. You might even feel like it’s something you will never understand, so why bother? That’s completely understandable; there is so much being thrown at us that we feel defeated before we even start.

However, the number of women not participating in financial planning could also be because many women don’t truly understand what’s IN a financial plan; it could sound like something abstract that doesn’t really apply to them.

The truth is that a financial plan can help you break down your finances into manageable pieces that help you reach goals you might think are unattainable. This isn’t some intimidating tool that only the rich use. It’s something that can help you not only plan for the future but also things like vacations and new cars.

"Are You Okay?" Check: Your financial plan gives you the inside scoop on how you're doing financially. It's like a buddy checking in to make sure you're not living on ramen noodles and boxed wine. If things are a bit shaky, it helps you figure out how to tighten things up.

Short-Term Goals Whisperer: Got those immediate dreams like a weekend getaway or snagging the latest gadget? Your financial plan helps you figure out if your wallet can handle the splurge. It's like having a friend who's great at budgeting and says, "Yeah, treat yourself, but let's not go crazy."

Long-Term Goals BFF: Thinking big—like buying a house, starting a family, or retiring on a beach somewhere? Your financial plan is the friend that says, "We got this!" It lays out the steps to make those dreams a reality and keeps you on track. It's like having a partner in crime for your money adventures.

Also, keep in mind that this doesn’t have to involve a long-term commitment. I often help clients during hourly consultations that require no obligation. Here’s what we might discuss:

I realize that taking the first step is hard, but once you get moving in the right direction, you’ll see how working with a professional can help you not only with your retirement goals…but the fun stuff as well.

Think about it. If you knew what was going to happen – whether it was on a personal or global scale – when it came to money, you’d probably feel less worried about it, even if it wasn’t positive. You’d know what was coming and have the ability to better prepare yourself, even if that meant doing things like downsizing or spending less.

Fear of the unknown is no small thing and it actually has a clinical term: xenophobia. “In modern usage, the word has evolved to mean the fear of strangers or foreigners — but its original meaning is much broader. It includes anything or anyone that’s unfamiliar or unknown.”

And while you might think that the symptoms are only in your mind, they can morph into something physical:

It can also show up in other ways:

In a piece from Healthline, they do offer some solutions to this problem.

Number five is where I come in.

It’s often difficult for people to make an appointment with a financial advisor because there are painful questions rolling around in most people’s heads:

I hope it’s a comfort to you when I tell you that everyone thinks these things; I don’t care if you have $200 in the bank or $200 million. Everyone has made a poor financial decision at some point. Everyone is afraid of being judged. Everyone is afraid that they’ll ask a question, and someone will laugh at them.

Because of these mental roadblocks, some people don’t take the step that will move them into the known: knowing where they are financially so they can make decisions that will keep them moving forward without that fear.

Julie is 45 and is worried she hasn’t saved like she should. She’s put money into her 401k but hasn’t always maxed out that benefit. Not only that, but she also took a trip to Europe with some friends last year that she put on a credit card she’s still trying to pay off.

The debt and worry for the future means Julie is lying awake at night, staring at the ceiling. She knows she should talk to someone about this, but she’s a little embarrassed about putting her financial cards on the table.

If Julie walked into my office (or my Zoom) we would first evaluate where she is right now and discuss what’s keeping her up at night – and we would get specific. Together we would look at the numbers and come up with a plan and she would know that that plan might change as her goals change. The bottom line is that this would give us a place to start and we would be able to adjust later if necessary.

Something that I think is important for people to know is that the situation is often not as bad as someone thinks it is. Where an advisor can help is to look at the numbers and run the projections, so you know how to plan and tackle life’s obstacles. We all have them!

Remember that having data and knowledge related to your specific situation always feels better than the unknown. If money is keeping you up at night, let’s talk.

Let’s face it – when we’re looking for a financial advisor, we’re often feeling scared and overwhelmed. We’re looking for someone to answer our questions without making us feel ashamed or talking over our heads. In other words…this process is sometimes not easy.

Now, imagine yourself sitting with a financial advisor, wondering if they’re going to be friendly. Wondering if they’re going to judge you. Wondering if they’re an ally.

When I have a potential client in the LGBTQ+ community come into my office, they might not automatically know that I am an ally until we start speaking. I’m hopeful that they immediately understand that I am, but when I put myself in their shoes – walking into a stranger’s office not knowing if they will be welcome – it makes me cringe. No one should be put in that position.

If you’ve been thinking that it’s time to talk to a financial professional, but you’re not sure where to start to find a trusted resource, here are some ideas:

One of the best ways to find an LGBTQ+ friendly financial advisor is by asking for referrals from trusted sources. This can include friends and family who are part of the community, local LGBTQ+ organizations, or online forums. By seeking referrals, you not only get first-hand accounts of positive experiences, but you also get a sense of their process and whether or not they are a good fit for you.

There are several websites you can visit that will allow you to specifically search for LGBTQ+ friendly financial advisors. Here are a few to get you started:

Once you've found a few potential advisors, it's time to start asking the right questions. This includes asking about their experience working with LGBTQ+ clients, their understanding of queer-specific financial needs, and their approach to investing. It's also essential to ask about their values and whether they support LGBTQ+ rights and causes. A competent and understanding financial advisor will have no problem answering these questions confidently and transparently.

When you’re looking for a financial professional…it’s personal. This is someone you should feel comfortable speaking with about most areas of your life, especially as they relate to your finances. This is not someone you should hesitate to call when something happens. This is someone you should know is in your corner to help support you through life’s changes.

If you have any questions about how I work with queer clients and would like to know more about my process, I would love to have that conversation with you! CLICK HERE to schedule an appointment.

We’ve all been there. You’re having a normal conversation with a member of the opposite sex, and you can just feel it coming. You’re making your points. He’s making his. And then suddenly it happens.

The mansplain.

Unfortunately, this is an all-too-common occurrence in financial services, an industry dominated by men. We’re told that if we just cut down on our shopping, we’ll save more money. Or if we give up our one coffee a day. When couples visit an advisor, scenarios like these often happen:

“I was patronized if I asked questions” or “He would not make eye contact with me. I was just there.” And even, “Sometimes I would pick up a magazine and start reading it right in the middle of the meeting; he wouldn’t even notice.”

Here’s the disconnect: Women do have the capacity to understand money, despite being told for generations that we don’t.

(Source)

And if that wasn’t enough to wake you up to the fact that we should be given more credit than we are, here’s another one: Ninety percent of women will be responsible for their finances exclusively at one point in their lives.

In a perfect world, we wouldn’t consider gender at all when it comes to finding any service providers we’re looking for. But when it comes to money, a female advisor could have a different approach.

Simple: Who wants to get advice from someone who has no frame of reference for what you might experience on a daily basis?

As a financial advisor who works specifically with female clients, I know my approach is different from many of my male counterparts.

This is why I think this approach to successful financial planning is important:

In the essay “Men Explain Things to Me,” author Rebecca Solnit explains that mansplaining isn’t just annoying, but perpetuates the idea that women are inferior.

“It’s the presumption that makes it hard, at times, for any woman in any field; that keeps women from speaking up and from being heard when they dare; it crushes young women into silence by indicating, the way harassment on the street does, that this is not their world," Solnit writes. "It trains us in self-doubt and self-limitation just as it exercises men’s unsupported overconfidence.”

(Reporter)

At no time during a financial planning meeting should anyone feel talked down to or “less than” – this is your money, and you have everything it takes to understand it, make more of it, and manage it.

If you’re reading this and have either experienced the mansplaining scenario with your own advisor or it’s something you’re trying to avoid as you look for a financial planner, it’s important to think about the following.

Would you be comfortable talking to this person about:

If you’re picturing the mansplaining that could happen during one of these conversations with your financial advisor, it’s time to make a change.

Here’s how you should feel after a conversation with your advisor:

Ready to cut down on mansplaining in your own life? CLICK HERE to make an appointment.

If you’re a Gen X woman, the word “roommate” might conjure up memories of a tiny apartment or dorm room decorated with the posters you collected from the mall and plastic dishes we probably shouldn’t have microwaved.

Yeah, no one wants to go back there.

But if you’re sitting in your home alone, wondering what to do with all the space you have or wondering what aging as a single woman will look like a few years down the road…you might want to change how you think about the word “roommate.”

Lots of things have changed since our parents’ generation:

Many solo adults live in homes with at least three bedrooms, census data shows, but find that downsizing is not easy because of a shortage of smaller homes in their towns and neighbourhoods.

Compounding the challenge of living solo, a growing share of older adults – about 1 in 6 Americans 55 and older – do not have children, raising questions about how elder care will be managed in the coming decades. (StraitsTimes)

Factors like these change how we think about aging and independence. This means that the options available need to change as well.

Any extra funds that you can bring in can lead to more retirement savings; every dollar helps. If you are in the distribution phase of your retirement, you are potentially compounding the impact of money brought in from a roommate.

If you’re not quite in the distribution phase of retirement, keep in mind that home-sharing is a great way to generate passive income that can be used as an investment in your future. By using the money you make from home-sharing wisely—such as putting it towards long-term investments or contributing it towards a 401K—you can significantly increase your retirement savings over time. Additionally, since home sharing is considered rental income by the IRS, any profits made from renting out your space may be eligible for tax deductions which could further reduce your taxable income in retirement years. As always, it is best to consult your tax professional for further clarification.

As always, the best first step is to make sure you have a very good handle on exactly how much you need to save for retirement; this is when it’s a good time to talk to your financial advisor. If you have run retirement scenarios and are coming up short on funds for your retirement goals, adding income from a roommate can bridge that gap. Perhaps you are okay with hitting your retirement savings, but your retirement is looking a little dull. You might be able to expand your options for what your retirement can look like by saving more money and setting DREAM retirement goals!

Aspen Wealth Management and LPL Financial do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.