When it comes to women and finances, you’ll come across a lot of articles and self-help content that says we need to be more confident.

But that’s not really the case.

According to the Equitable Women and Wealth Study, “Women control more than one-third of all U.S. household financial assets, a share that is likely to grow significantly in the years ahead. This trend has been occurring for decades as women continue to earn higher incomes, becoming the sole financial decision-makers in their households.”

And when it comes to the stats on women and investing, we’re looking pretty good: “More than half (51%) of women who invest in the market say they typically stay the course on their investments when the market experiences a dip, compared to 43% of men.”

Is there room for improvement? Sure. But studies are showing that confidence isn’t the issue.

This is a question that I started thinking about recently and, fortunately, I came across an article in Medium that I think explains it rather well.

In Comfort > Confidence, author Andrew Yang explains that confidence is the next step past being a rookie who doesn’t know anything; comfort is what happens when you’re a master.

You’re most likely nervous at the beginning because you’re a rookie and frankly, you have no idea what you’re doing.

As you learn all the techniques and get better, you’re able to perform everything correctly and with confidence. You’re a pro.

But at some point, you simply relax. Everything is second nature, and you perform even difficult tasks with unthinking ease. You even start inventing new techniques that break old rules. You’re a master.

Masters are beyond confident — they’re comfortable.

In other words, more and more women are already in the “confident” phase when it comes to their finances. Now we need to get comfortable.

Before I answer that question, let’s talk about WHY that’s important.

And, yes, I’m going to throw another statistic at you.

There have been copious studies performed on how men and women manage money when it comes to investments. Most conclude that men are more confident in their financial knowledge and more open to risky investments, while women are more cautious, future-focused investors.

In my work with single Gen X women, I have found this to be true. Until a woman is completely comfortable with her finances and understands the reasoning behind certain investment decisions, she’s not as willing to take risks as her male counterpart might be. However, once she receives financial education about what we’re doing…she’s usually on board AND feels good about it.

The good news is - and again this is according to my experience - most women are more open to having things explained to them than men are. They’re more willing to say, “I don’t know” when asked a question. They’re willing to ask for help. They’re open to learning – and I think that’s the key that will move women from “confident” to “comfortable.”

I’m betting that when you read the difference between confident and comfortable, you knew immediately what I was talking about. We can physically feel the difference between the surge of energy that comes with confidence and the relaxed feeling that comes with comfort.

So, how do you get there?

Ready to get comfortable with your finances? Let’s talk.

Understanding investment account fees, particularly in vehicles like 401(k)s, can be challenging. However, it's important to understand these concepts to ensure you're making informed decisions about your financial future.

So, let’s talk about common fees and understanding share classes.

While fees are a necessary part of investing (or receiving any service, really) they can unnecessarily eat into your returns over time if you're not careful. The key is to understand what you're paying for and whether the costs are justified. There are various types of fees you might encounter, including expense ratios, administrative fees, and sales charges.

Expense Ratios: One of the most common fees you'll encounter in investment accounts is the expense ratio. This fee represents the percentage of your investment that goes toward covering the fund's operating expenses and are charged in an ongoing basis. You may have to dig around to find these fees; they are not always shown front and center, but they absolutely exist. If you can’t find them, call the financial services company and ask what they are for *each* fund that you own. You will want to compare the expense ratios against those of other similar investments available to you.

Even seemingly small differences can have a significant impact on your long-term returns.

Administrative Fees: In addition to expense ratios, many investment accounts, such as 401(k)s, come with administrative fees. These fees cover the costs of managing the account and providing services like record-keeping for the IRS and customer support. Administrative fees are often easier to see than expense ratios, they are not the only costs associated with your account (see expense ratios above!).

Sales Charges: When buying certain investment products, such as mutual funds, you may encounter sales charges or loads. These fees are different for each share class (see below) and are typically paid to financial advisors or brokers. These can come in the form of front-end loads (paid when you buy the fund) or back-end loads (paid when you sell the fund). There are often less expensive options, so it's essential to consider these charges when evaluating the overall cost of investing in a particular fund.

Share classes are another aspect of investment fees that can confuse investors. Essentially, share classes represent different versions of the same mutual fund or investment product, each with its own fee structure. Common share classes include Class A, Class B, and Class C shares.

Class A Shares: Class A shares typically come with a front-end sales charge but lower ongoing expenses. The selling point of A shares is that it can be more cost-effective if you’re planning to hold the investment for an extended period, but it is impossible to see into the future and know how long you plan to keep a particular fund. You should also check the expense ratio to see if the ongoing expenses are that much less expensive.

Class B Shares: Class B shares often have higher ongoing expenses but don't charge a front-end sales load. Instead, investors may incur a back-end sales charge if they sell the shares within a certain timeframe.

Class C Shares: Class C shares can have higher ongoing expenses and may impose a back-end sales charge if sold within a specific period. These shares are often favored by investors who don't plan to hold the investment for an extended period and prioritize liquidity and the ability to rebalance their asset allocation on a regular basis.

Understanding the fees associated with your investment accounts is a crucial step toward pursuing your financial goals. Remember to consider not only the costs but also the potential benefits of each investment option. If you're unsure about the fees in your investment accounts, that’s where a financial advisor can help you make informed decisions.

Your financial future is too important to leave to chance. CLICK HERE to make an appointment.

In 2023, #girlmath gained momentum on social media, poking fun at how people – women in particular - justify making frivolous purchases like handbags and vacations. And while I don’t want you to think I’m a financial advisor with no sense of humor…I can’t help but feel like the term “girl math” is detrimental to all the hard work we’ve put in trying to get the world to understand that women are just as good at financial planning as men are.

First, let’s look at the statistics. According to Gitnux, when it comes to spending, women are ahead of men with 70-80% of consumer spending while men make up the rest. But here’s where men pull ahead in the spending race:

But even if we didn’t have the numbers to show that men can be frivolous spenders, too, it’s important to note that our words can have a negative impact – even when it’s supposed to be a joke.

Let’s first talk about what “girl math” is: It’s supposedly a way for women to justify needless spending. So, what does that imply?

Overall, it perpetuates harmful stereotypes and creates a divisive atmosphere, particularly in financial education. It implies that girls are somehow inherently worse at or less capable of managing finances than boys.

According to AAUW, “Many girls lose confidence in math by third grade. Boys, on the other hand, are more likely to say they are strong in math by 2nd grade, before any performance differences are evident.”

Also, “STEM fields are often viewed as masculine, and teachers and parents often underestimate girls’ math abilities starting as early as preschool.”

I can’t imagine that it helps that there is a social media trend going around that is saying to young girls, “The world thinks you’re frivolous and can’t manage your money. You can see that millions of girls are doing it – so, it’s okay if you do it, too.”

Again, while the videos are funny, I would imagine that most women who see them get a little feeling in the pit of their stomachs that something isn’t right – that women aren’t being represented well through this label.

The truth is that both genders seem to have their flaws when it comes to spending and both have their strengths when it comes to saving. And most of the issues that people have around money they would have regardless of gender – we just seem to feel comfortable categorizing things as masculine or feminine.

What “girl math” is – generally speaking – is poor budgeting skills. Which both genders can be guilty of.

Language matters. The words we use can have a powerful impact on how we perceive ourselves and others. By flippantly categorizing poor spending habits as inherently female, those of us who are laughing at it are undoing a lot of progress.

As you may or may not have heard, some of you might be coming into some money.

Like, a lot of money.

It’s estimated that $84.4 trillion will be handed down through 2045 – and $30 trillion of that will be given to women.

This is, obviously, good news for several reasons. For example, “a U.S. study by the Women’s Philanthropy Institute found that as women’s income rises, they become more likely to give to charity than their male counterparts.”

But it could also mean big things for women when it comes to their financial confidence. According to Financial Advisor IQ, “receiving a financial windfall increases women's confidence 1.8 times — from 45% reporting that they're confident with money, to 81%. And it means that they become more confident about their ability to manage their money than even men are (at 77%)."

The thing is, being prepared and educated is the key to successfully managing an inheritance. In 2015, MarketWatch reported that “one-third of people who received an inheritance had negative savings within two years of the event.”

Don’t let that be you.

When it comes to money, you deserve to feel confident and secure. Here are a few things that might help you build a solid foundation, whether you’re receiving an inheritance or not.

Education and Knowledge: Invest time in learning about personal finance concepts, such as budgeting, saving, investing, and retirement planning.

Set Clear Financial Goals: Define short-term and long-term financial goals that are specific, measurable, achievable, relevant, and time-bound.

Invest in Yourself: Invest in your skills, education, and career advancement to increase earning potential and financial security.

Challenge Limiting Beliefs: Identify and challenge any limiting beliefs or negative attitudes about money that may be holding you back.

Start Investing: Overcome any fear or hesitation about investing by starting small and gradually increasing your investment knowledge and confidence.

And guess what? A financial advisor can help you with all of these things.

It might be time to start interviewing advisors to find the right fit before you suddenly have money in your bank account that you could blow through without even realizing it. Working on some money skills ahead is always a good idea and can prepare you for what’s coming, whether it’s an inheritance or some other unexpected event.

Bottom line: Don’t wait for an inheritance to boost your money confidence.

The financial history of women in the United States is a story of determination, resilience, and progress – although not as quickly as many of us would like. When I look at the timeline of historical events below, I can’t help but feel like some pretty basic – yet, crucially important – rights were given to women just a short time ago.

From the struggle for property rights to the fight for equal pay and access to credit, women have played pivotal roles in shaping the economic landscape of the nation. This timeline highlights significant events that have marked the journey of American women towards financial empowerment.

Mississippi becomes the first state to grant married women the right to own property in their own names, providing them with a measure of financial autonomy.

The Seneca Falls Convention in New York marks the beginning of the women's suffrage movement in the United States, laying the foundation for future advancements in women's rights, including financial rights.

President Abraham Lincoln signs the Morrill Act, which grants land to states for the establishment of colleges and universities. This opportunity expands educational opportunities for women, empowering them with knowledge and skills to participate in the workforce.

The 19th Amendment to the United States Constitution is ratified, granting women the right to vote. This landmark achievement opens doors for greater economic and social empowerment for women across the nation.

The Equal Pay Act is signed into law, prohibiting wage discrimination based on gender and laying the groundwork for pay equity in the workforce.

The Equal Credit Opportunity Act is enacted, prohibiting discrimination in credit transactions on the basis of sex and marital status. This legislation grants women greater access to credit and financial independence.

The Women's Business Ownership Act is signed into law, facilitating access to capital and resources for women entrepreneurs, thus fostering the growth of women-owned businesses.

The Violence Against Women Act is passed, providing legal protections and support services for victims of domestic violence and financial abuse, recognizing the intersectionality of gender-based violence and financial security.

The Lilly Ledbetter Fair Pay Act is signed into law, extending the statute of limitations for filing pay discrimination claims and promoting greater pay transparency and accountability.

The Dodd-Frank Wall Street Reform and Consumer Protection Act is enacted, introducing regulatory reforms aimed at promoting financial stability and consumer protection, including provisions related to gender pay equity and diversity in corporate leadership.

While it can be disheartening to realize that there is still so much work yet to be done, this timeline DOES highlight the monumental issues that the women before us have tackled. Rather than be frustrated by the slow changes that have happened over the years, I’m going to try to remind myself that change is possible – and I can be part of it.

In my own financial planning practice, I’ll continue to educate women about their finances and encourage them to negotiate for better pay. We’ll work together to find solutions to things like the toll that caregiving can often take on their careers and I know I’ll continue to be inspired by the moments of success my clients achieve.

Ultimately, by learning from the past and continuing to advocate for change, we can work towards a future where all women have the opportunity to thrive financially.

When it comes to women and finances, it’s almost never been an even playing field.

Setting aside the wage gap and the often-unfair distribution of work that women encounter between their professional life and being a caregiver, let’s talk about the little things that women are told over time that can undermine their confidence when it comes to finances.

As a woman, how many times have you read or heard something along the lines of, “Well, if you just stop shopping so much (or don’t buy that latte or whatever the overused example is), it will make a huge difference in your finances”?

And how many times do you think someone has said that to a man?

Let’s be honest. Here’s what men often hear: “You need to get that promotion and make more money if you want to save more.”

And women?

“You need to stop buying so many shoes.”

While budgeting is an important part of financial planning, it’s unlikely that stopping your Starbucks habit is going to bring about the financial change you’re looking for. Shift your mindset to something that looks a little bit more like this:

I want to spend more. I want to save more. Therefore, I should make more.

As women, we’re often in situations where we can speak up…but we don’t. Many of us have been raised to put the comfort and needs of others before our own and that can hurt our chances of getting what we want. However, that’s doing ourselves and possibly the company a disservice.

“If you feel uncomfortable asking for more money, remember that unapologetically requesting the money you deserve is providing a service to yourself, your employer, and your community,” says Prism Impact Founder Mari Geasair. “When you are clear about the value you offer and the money you need you can show up and do your work with less stress, distraction, and potential resentment. You are also paving the way for other women to receive the compensation they deserve and for employers to recognize what it takes to hire and to retain the best talent.”

Mari offers this tip: “When it is time to discuss money matters with your employer, frame the conversation as working together to solve the challenge of getting you the compensation you need so that you can consistently bring your best talents and focus to the job. You are doing everyone a service when you thrive financially.”

“Four out of five women get a wage increase after requesting one, according to a new survey by job postings website Indeed…. But less than a third, or 31 percent, feel comfortable asking for more money, and only 46 percent of women have requested a raise throughout their careers.” (Source)

Before you decide to change jobs, it could be time to discuss a raise or at least a game plan with your management. Here’s a series you can take a look at for some inspiration:

If it’s time to make a change altogether, tap into resources that might help you land that dream job – and dream salary. For example, you might want to talk to a career coach as I did in this interview with Emily Frank.

Think it’s too late to make a major change, like starting your own business? Think again. “Research shows that entrepreneurs in their 50s and over are twice as likely to be successful as those in their 20s - something that can be put down to one main factor: experience.” (Forbes)

This could be a major swing for you, or it might be something you ease into. Here are a few things to consider from ZenBusiness if you’re thinking of starting your own business:

One of the best things about getting older is we know what we want. Now we need to do what’s necessary to get it. While you might have been thinking about making some changes for a while, I know that it can be scary to ask for that promotion or start that new business.

Working with a financial advisor who will not only guide you toward the future you envision but who will also encourage you along the way could make a big difference. They can also help you look at the situation honestly so you can make educated decisions about your next steps.

However, if you find yourself in a financial advisor’s office who is encouraging you to give up happy hour with your friends as a means of financing your financial goals, run.

And then call me.

Let’s face it – when we’re looking for a financial advisor, we’re often feeling scared and overwhelmed. We’re looking for someone to answer our questions without making us feel ashamed or talking over our heads. In other words…this process is sometimes not easy.

Now, imagine yourself sitting with a financial advisor, wondering if they’re going to be friendly. Wondering if they’re going to judge you. Wondering if they’re an ally.

When I have a potential client in the LGBTQ+ community come into my office, they might not automatically know that I am an ally until we start speaking. I’m hopeful that they immediately understand that I am, but when I put myself in their shoes – walking into a stranger’s office not knowing if they will be welcome – it makes me cringe. No one should be put in that position.

If you’ve been thinking that it’s time to talk to a financial professional, but you’re not sure where to start to find a trusted resource, here are some ideas:

One of the best ways to find an LGBTQ+ friendly financial advisor is by asking for referrals from trusted sources. This can include friends and family who are part of the community, local LGBTQ+ organizations, or online forums. By seeking referrals, you not only get first-hand accounts of positive experiences, but you also get a sense of their process and whether or not they are a good fit for you.

There are several websites you can visit that will allow you to specifically search for LGBTQ+ friendly financial advisors. Here are a few to get you started:

Once you've found a few potential advisors, it's time to start asking the right questions. This includes asking about their experience working with LGBTQ+ clients, their understanding of queer-specific financial needs, and their approach to investing. It's also essential to ask about their values and whether they support LGBTQ+ rights and causes. A competent and understanding financial advisor will have no problem answering these questions confidently and transparently.

When you’re looking for a financial professional…it’s personal. This is someone you should feel comfortable speaking with about most areas of your life, especially as they relate to your finances. This is not someone you should hesitate to call when something happens. This is someone you should know is in your corner to help support you through life’s changes.

If you have any questions about how I work with queer clients and would like to know more about my process, I would love to have that conversation with you! CLICK HERE to schedule an appointment.

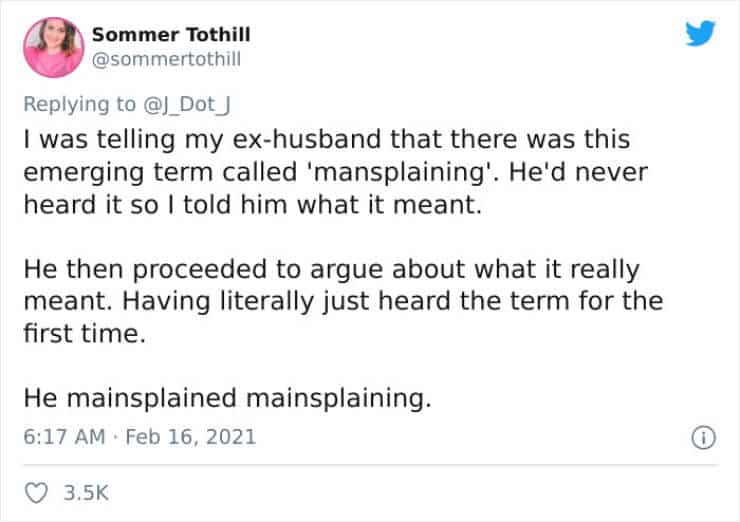

We’ve all been there. You’re having a normal conversation with a member of the opposite sex, and you can just feel it coming. You’re making your points. He’s making his. And then suddenly it happens.

The mansplain.

Unfortunately, this is an all-too-common occurrence in financial services, an industry dominated by men. We’re told that if we just cut down on our shopping, we’ll save more money. Or if we give up our one coffee a day. When couples visit an advisor, scenarios like these often happen:

“I was patronized if I asked questions” or “He would not make eye contact with me. I was just there.” And even, “Sometimes I would pick up a magazine and start reading it right in the middle of the meeting; he wouldn’t even notice.”

Here’s the disconnect: Women do have the capacity to understand money, despite being told for generations that we don’t.

(Source)

And if that wasn’t enough to wake you up to the fact that we should be given more credit than we are, here’s another one: Ninety percent of women will be responsible for their finances exclusively at one point in their lives.

In a perfect world, we wouldn’t consider gender at all when it comes to finding any service providers we’re looking for. But when it comes to money, a female advisor could have a different approach.

Simple: Who wants to get advice from someone who has no frame of reference for what you might experience on a daily basis?

As a financial advisor who works specifically with female clients, I know my approach is different from many of my male counterparts.

This is why I think this approach to successful financial planning is important:

In the essay “Men Explain Things to Me,” author Rebecca Solnit explains that mansplaining isn’t just annoying, but perpetuates the idea that women are inferior.

“It’s the presumption that makes it hard, at times, for any woman in any field; that keeps women from speaking up and from being heard when they dare; it crushes young women into silence by indicating, the way harassment on the street does, that this is not their world," Solnit writes. "It trains us in self-doubt and self-limitation just as it exercises men’s unsupported overconfidence.”

(Reporter)

At no time during a financial planning meeting should anyone feel talked down to or “less than” – this is your money, and you have everything it takes to understand it, make more of it, and manage it.

If you’re reading this and have either experienced the mansplaining scenario with your own advisor or it’s something you’re trying to avoid as you look for a financial planner, it’s important to think about the following.

Would you be comfortable talking to this person about:

If you’re picturing the mansplaining that could happen during one of these conversations with your financial advisor, it’s time to make a change.

Here’s how you should feel after a conversation with your advisor:

Ready to cut down on mansplaining in your own life? CLICK HERE to make an appointment.

If you’ve ever looked at your married friends and assumed that they have an advantage over you financially…you might be surprised.

Recent research from the Center for Retirement Research at Boston College found women who have spent most of their lives married tend to fare worse than never-married women. The reason is largely due to the declining wealth of their spouses. Because never-married women’s wealth has mostly stayed stable, their wealth has increased relative to their mostly married counterparts, according to the report.

An unexpected divorce or death of a spouse can also upend their financial plans in retirement. (CNBC)

There are other reasons why you might have a bit of an advantage over your married friends:

Sure, the buck always stops with you and that can be overwhelming at times – but it can also make life easier when you don’t have to take someone else’s situation into account. This also means that you can be more consistent with your day-to-day budget and long-term savings.

It’s not uncommon for married couples to have differing opinions on what the future holds; one spouse might be focused on long-term retirement planning while the other just wants to live for today. As a single woman, you don’t have to deal with competing ideas and goals. You can decide how you want to live and do it!

As a single woman, you have the freedom to explore different professional opportunities without worrying about how your job will impact someone else. This can mean more money over time AND allow you to save for the retirement you want. As a side note, understanding how to negotiate and taking advantage of career development opportunities can also help your bottom line.

It’s not uncommon for couples to disagree on who they might use for a financial advisor – or for a husband to make that decision for the couple. As a single woman, you have control over who you work with – and you’re able to choose who you’re comfortable with without taking another personality into consideration.

As a single woman, you’re used to taking control in many areas of your life – and that’s a GOOD thing. My goal as an advisor is to make sure you have as much confidence about your finances as possible, so you know you’re on the right path. Have questions? Let’s talk.