When it comes to entertaining during the holiday season, the menu can feel like a minefield.

I know this because I’ve been eating gluten and dairy-free for health reasons for well over 10 years (okay, sometimes I eat gluten-free pizza and it’s worth it) and I always appreciate my friends and family who make the effort to cook dishes I can eat.

And I know I’m not alone. According to JAMA Network, “In a population-based survey study of 40 443 US adults, an estimated 10.8% were food allergic at the time of the survey, whereas nearly 19% of adults believed that they were food allergic. Nearly half of food-allergic adults had at least 1 adult-onset food allergy, and 38% reported at least 1 food allergy–related emergency department visit in their lifetime.”

So, I know that there are people out there who are gearing up to entertain over the holidays…and are looking for recipes that might accommodate someone with food sensitivities.

Spinach Stuffed Portobello Mushrooms: These are delicious and don’t scream “SPECIAL FOOD.”

Gluten Free Lemon Curd Cookies: These cookies are one of my favorites – they’re super impressive and not difficult. (You can buy lemon curd at stores like Trader Joe’s, no need to make that yourself unless you want to. Check with your dairy-free guest to see if they can eat butter). This entire site has amazing gluten free desserts and breads.

Gluten-free Pumpkin Pancakes: If your guests are staying overnight and you want to serve a fun breakfast.

It can seem overwhelming to accommodate those with food allergies, but it doesn’t have to be difficult. It has become much easier to find alternative ingredients such as gluten-free flour blends, or vegan alternatives at your regular grocery store (especially here in Colorado).

Trust me, your guests will really appreciate the effort!

With the FIFA Women’s World Cup underway, the world is watching some extraordinary talent on the soccer field.

It’s also watching some startling statistics regarding what these professional athletes are getting paid.

Soccer players at the 2023 Women’s World Cup will on average earn just 25 cents for every dollar earned by men at their World Cup last year, a new CNN analysis found.

Still, that is an improvement: last time, in 2019, it was less than eight cents per dollar, according to data provided by world governing body FIFA and global players’ union FIFPRO.

The report also found that, across the board, top female players get paid the same or less in a year than what male soccer players of the same level receive per month.

While the numbers above are astonishing, it’s nothing new. Here are some facts according the US Department of Labor:

With the wage disparity that women have endured since the beginning of time, one might wonder how things can get better.

As a financial advisor who works with women, I strongly advise you to get smarter about your money. If we can’t immediately level the playing field with our paychecks, that means we need to be more proactive with our planning. Talk to an advisor who understands you and who has walked in shoes similar to yours.

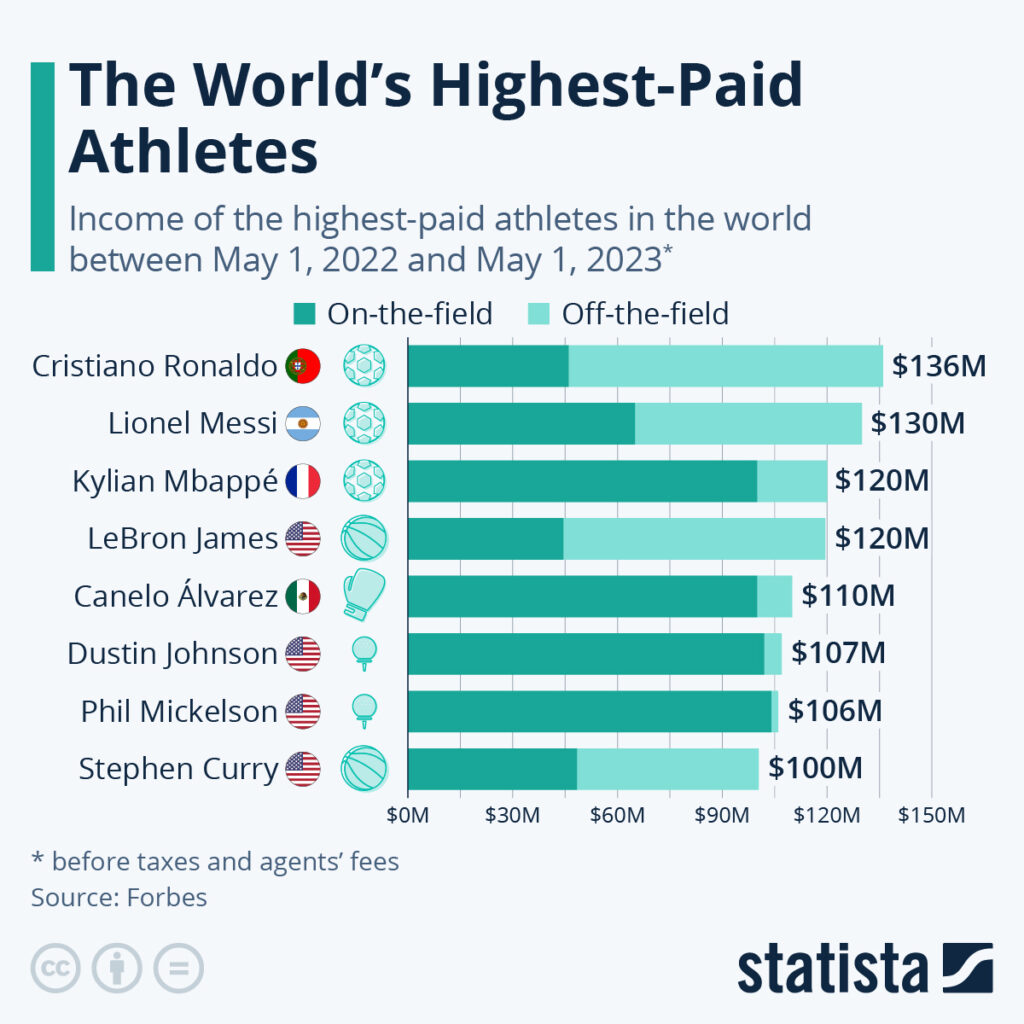

I’ll leave you with one more startling chart. See any women on it?

When it comes to any kind of family planning, one of the biggest concerns for most parents is the cost. There are the basic costs of food, clothing, and education - but what if that cost is multiplied by the effort to have the baby in the first place?

If you’re one of the many women who have had to look at alternatives to starting a family, I know this can be an incredibly stressful time for you. I also know that adding the financial burden of fertility treatments only contributes to that anxiety. So, let’s take a look at what we can control.

First, let’s understand the numbers. Forbes Health reported that a single IVF cycle in 2023 can range from $15,000 - $30,000. Investopedia estimates that egg freezing (oocyte cryopreservation) can cost $7,000 - $10,000. Adoption fees can also vary widely.

Take a deep breath. It’s not all bad news.

While many insurance companies might not cover fertility treatments, you never know until you ask. Some insurance plans may cover fertility testing and diagnosis, and some states require insurance companies to cover some aspects of fertility treatments. Additionally, your employer-sponsored health plan may offer some financial assistance.

Several organizations offer financial assistance for fertility treatments. The National Infertility Association is one organization that offers grants for fertility treatments to those who meet the eligibility criteria. Additionally, clinics may also offer discounts or payment plans for fertility treatments.

In previous pieces, we’ve talked about how important it is to share milestones and possible decisions with your financial advisor – and if you’re considering fertility treatments, this certainly falls into this category.

When I speak with women who are embarking on this journey, we discuss their financial options. For example, we look at tax-advantaged money such as Health Savings Accounts and if it might be possible to withdraw money from a Roth with limited consequences.

Overall, we look at the numbers and discuss how diverting funds from other areas might affect your financial plan. For example, you may be tempted to stop contributions to retirement accounts or even take money out of a retirement account. (But please don’t do this without speaking with a professional!) An advisor can also identify appropriate investments for what is most likely a shorter savings time frame.

Family planning is such an exciting time for you and for me! I love helping my clients from the moment they think about expanding their family to further down the road as we look at education funding and making other major decisions. So, don’t leave your advisor out of the conversation; helping you with these milestones is why we love what we do.

There are a lot of great things about being single when it comes to your finances:

Bottom line: financial planning looks a little different when you’re single. I should know. I spent most of my adult life as a single woman and didn’t get married until I was in my 40s. So, I’m well aware of the pros and cons you’re dealing with…and the – sometimes unrealistic - financial advice you might be getting.

That’s all us financial planners talk about, right? “Save ALL your money! Your future self will thank you!”

However, the RIGHT financial planner always takes your personal situation into account. For example, I would never give a single woman in her 40s the same advice I would give a married couple in their 40s; their situations are different, and their plans should reflect that.

Anyway, I remember being single and constantly hearing that same broken record about saving…but I realized pretty quickly that my lifestyle was different because I didn’t have a partner. Never spending money or staying home because I needed to save every penny until all my retirement accounts were maxed or my debt was paid off was unrealistic.

What am I…a nun?

To be social as a single person usually takes at least a little bit of money. You go out with friends or maybe have them over and entertain. If you’re dating, that requires some spending, too. People who are partnered at least have another person at home with whom they socialize, so it’s possible to cut back on spending and enjoy nights at home. But being on your own is different.

Having a financial plan that wouldn’t allow me to spend at all would have required me to isolate myself more than I probably should have. From a personal perspective, I would have never been able to hold off seeing friends until my financial goals were 100% reached. I would have been miserable.

Hang on. Don’t take this too far.

What I hope you’re getting from this blog is that if you walk into a financial planner’s office – no matter what your situation is - and they start using words like “always” or “never” you might want to walk back out again. Advice should be tailored to each individual situation and what is reasonably attainable.

What your plan SHOULD do is allow you to live your life now while planning for the future. This means that if you require more money to be social because you don’t like being alone, you should discuss that with your advisor; they can take that into account and help you come up with a spending plan.

So, if you’re reading this and thinking the following…

…let’s talk. I get it.

Have you ever fluctuated between knowing you need to save…and wanting to live life to the fullest?

I would think that many of us have argued with ourselves about that at least a few times over the course of our lives. And I’m about to offer a solution to that.

A budget.

Wait! Don’t close this blog just yet! Hear me out.

No one – and I mean NO ONE – wants to sit down and create a budget. I’m picturing some couple in the 80s sitting at their kitchen table with one of those big clunky calculators fighting over how many times they went to Burger King the month before.

The NEW way to budget is to create a spending plan. See? That sounds better already. When you create a spending plan, you’re giving yourself permission to spend in certain areas, so you don’t have to have that moment of guilt before you hit “purchase” – you know it’s okay.

The thing about creating a spending plan is that we all think about money differently depending on our personality type and our life experiences. In my eBook, Stop Financial Freakout, I talk about four different money mindsets.

Let’s take a look at how each one would handle putting together a spending plan:

A giver would put off crafting a spending plan because they are too busy with all of their commitments to other people. They would definitely have a “charity” line item as well as a “gifts” category.

A keeper crushes budgeting. They pay themselves first, and have allocations for emergency savings, travel fund, replacement car account, retirement, and a line item to save for their parent’s retirement because they will probably need help and they want to be ready.

What’s a budget? They just look at their checking account balance and that’s how much money they have left until payday.

A perfectionist has already downloaded budgeting software, and meticulously tracks every penny they spend, but doesn’t allocate any money for fun because what if they don’t have enough savings? As soon as they hit “X” goal then they will spend some money on themselves. And then the goalpost keeps moving because one can never be sure they have enough money saved, can they?

Do you see yourself in any of these scenarios? In the next blog we’ll talk about how each money personality can effectively put together their own spending plan, so they hopefully won’t have to decide between saving and FOMO!

With all the turmoil we’ve experienced during the last few years, it’s important to concentrate on the positive side.

According to CNBC.com, “Over the past couple of years, the effects of Covid-19, social activism and economic uncertainty have profoundly impacted women’s attitudes about their finances, according to a UBS survey.

Nearly 9 in 10 women believe money is a tool to achieve their personal “purpose,” the report uncovered, polling 1,400 women investors in January and February 2022.

“Many women have a deeper commitment than ever before to leading more purposeful, intentional lives and making a positive difference in the world,” said Carey Shuffman, head of the women’s segment for UBS.”

While we’re always tempted to send money where it’s needed, it’s also important to make sure your money is being used wisely – both by the charity and in your financial plan. Here are three steps to help ensure your money is going where it should.

Research organizations that align with your values. Do you want to help a smaller organization? Global or local initiatives? Here are a few questions from Fidelity Charitable to ask non-profits before you commit your funds:

When I work with a client, it is helpful for me to understand their values when crafting their financial plan.

For example, is it more important for you to retire early and spend time with your family or to have more money to spend in retirement? Or, if not being a burden to your children is important, we may allocate more money to long term care insurance.

We can use the conversational tools I use to determine values to help select charities.

Another important aspect of charitable giving is understanding how it affects your taxes.

I also like to show my clients ways to “help” without giving money. There are myriad investments that are focused on doing good, such as individual companies and mutual funds that are focused on helping women, or clean energy. It can be hard to sort through them all and make sure that they really are investing in line with their mission statement – I have tools to use and experience to help select these investments.

I can also help you figure out how much you have to give, and where that will come from. You can also see how it will affect your overall plan; for example, if you donate 5% of your income to charity each year, you may only have to work 1-2 years longer to reach your same goals in retirement and that may absolutely be worth it for someone charitably minded.

We’ll also discuss your estate plan and how charitable giving might play a part. You may not have cash flow to give right now, or money to invest, but leaving money to charity as part of an estate plan can be very beneficial to those charities. Beneficiaries get the full value of your assets without taxes on gains (“a step-up in basis”).

If you’ve been watching the news and are finding it endlessly depressing, giving back could be a wonderful way to feel a little more in control. If this is something you’re considering, I would be happy to discuss your options with you and help ensure your money is helping both the cause and your financial plan.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

If you click on this article - 8 Reasons Gen X is Especially Good With Money – you might wonder why I, a financial planner, am talking about it. After all, in the opening paragraphs it says this:

Born between 1965 and 1980, they're used to doing things for themselves, so they don't need to waste money paying someone to manage their money or tell them how to manage financial stress. They'll handle it all themselves, thank you.

So, while it might seem counterintuitive to point out that Gen Xers don’t want to pay for financial services, there are some qualities about this generation that make them perfect for professional financial planning.

A productive financial planning partnership between a client and an advisor embraces all of those qualities. Yes, we’re there to create a plan, but it’s also up to the client to implement some of the pieces.

Every advisor has had a client who has come back to them disappointed in an outcome they were hoping for, and every advisor has asked the question, “Did you do [this part of the plan that we talked about before]?”

The answer is almost always no.

The fact that Gen Xers are more open to new ideas when it comes to their financial plan AND are more likely to follow through with them, makes this a win-win for both the client and the advisor.

“Gen X'ers are more likely to have a 401(K) and believe that the ability to save for retirement is mainly their responsibility.”

Perfect. Let’s come up with a plan to get you where you want to go because I know you’re going to implement it. You like to do things for yourself and I’m going to give you the tools to do it.

“…they are more likely to manage their time and make sure they have enough time for both work and play. And this extends to their choices for how to make money.”

YES. Let’s create a plan that not only prepares for the future but allows you to enjoy life now. You understand the need for a diversified portfolio. I understand that everyone’s goals are different. Together we’ll do something amazing.

“Gen X'ers are more likely to start their own businesses, have online brokerage accounts, and invest in a broader range of assets than other generations.”

I love that you want to start your own business and that you also understand that we don’t save for the future like our parents did. You know that it’s up to you to create the future you want; pensions are pretty much a thing of the past and you’ve adapted to that change. You also understand that a plan needs to be fluid and you’re willing to communicate these changes with your advisor. There’s no shame there; it’s just life!

As with most things – yes – you can go it alone. You can fix your own car. You can do your own taxes. You can replumb your entire house. I know you have it in you do it all.

But do you WANT to?

Let’s take the amazing qualities you already have and make them work for you and your money. CLICK HERE to contact me.

It’s certainly no secret that healthcare costs have escalated in recent years, and there’s no reason to believe that the end is in sight. But whether you have a comprehensive health insurance policy or have purchased a catastrophic policy, there are ways to save on healthcare costs.

Here are just a few:

1. Stop going to the emergency room for minor illnesses. There are many reasons why going to the emergency room is a good idea. A cold or the flu is not one of them. Urgent care centers are designed to handle non-emergency medical situations from coughs, colds, the flu, to minor cuts, scrapes, and bruises. If you have a comprehensive insurance plan, your co-payment for urgent care will likely be half of what the emergency room co-payment would be. And if you’re paying out of pocket, an urgent care bill will likely amount to about one-tenth of what an emergency room bill would be. Save the emergency room for emergencies, and go to the urgent care route instead.

2. Take advantage of a Health Reimbursement Account (HRA). Traditionally offered by larger employers, more small business owners are starting to offer HRAs to their employees. When signing up, you’ll choose the amount that you expect to pay in out of pocket healthcare related expenses in the upcoming year. When you have a reimbursable expense, you can file a claim with the plan administrator to be reimbursed up to the yearly amount requested, meaning the co-pays and other expenses that you have to pay out of pocket will be paid with tax-free funds. Many HRA plans now issue a card that can be used like a credit/debit card, so you can pay for medical expenses as they occur; eliminating the need to file a claim.

3. Sign up for a Health Savings Account. If your policy has an annual deductible of $1,300 for single coverage or $2,600 for family coverage, you’re eligible for a Health Savings Account. You can contribute up to $6,750 per year for a family policy, with $1,000 additional if over 55, and the savings can be used in the current or future years, unlike the HRA, which requires you to use the funds in the current year.

4. Pay attention to your medical bills. Hospital bills in particular are error-prone, billing for items and services never received. Before automatically paying any balance due, make sure that you actually owe the bill. But it’s not just hospital bills. Even bills from an office visit or lab may contain errors. Taking a few moments to review bills as they come in can help to ensure that the balance due is accurate.

5. Take the time to compare insurance plan options during open enrollment. Make sure that you compare your options, and don’t automatically sign up for the same plan, or the cheapest plan. In actuality, in many cases the cheapest plan may end up costing you the most if you have surgery, or spend any time in the hospital.

Other options include taking advantage of mail order prescriptions, utilizing health plan benefits such as free gym membership and telehealth options can also help you save. While healthcare may never be truly affordable, these and other options can help to minimize additional expenses.

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any Federal tax penalties. Individuals are encouraged to seek advice from their own tax or legal counsel. Individuals involved in the estate planning process should work with an estate planning team, including their own personal legal or tax counsel. Neither the information presented nor any opinion expressed constitutes a representation by us of a specific investment or the purchase or sale of any securities. Asset allocation and diversification do not ensure a profit or protect against loss in declining markets. This material was developed and produced by Advisor Websites to provide information on a topic that may be of interest. Copyright 2014-2018 Advisor Websites.

For years it was assumed that tax planning was reserved for the wealthy. While wealthy individuals will see the most benefit from tax planning, with big changes looming for the 2018 tax year, even middle-income earners can reap the benefits of tax planning.

Basic tax planning starts with your AGI or Adjusted Gross Income. This is your total income after any adjustments or credits have been applied. Reducing your AGI is the number one goal of many tax planners, and the easiest way to do this is to contribute money to a 401(k) or other retirement plan. By the way, 401(k) contribution limits have increased for 2018, with those under 50 able to put away up to $18,500, while those over 50 can contribute up to $24,500. IRA contribution maximums have also increased, with a maximum of $5,500 in 2018, while those over 50 can contribute up to $6,500. Contributing to a qualified retirement plan is the easiest way to positively impact your AGI; reducing your taxable income while also building your nest egg for the future.

Another way to minimize your tax liability is to simply change your withholding exemptions on your W4 certificate. In fact, the IRS is recommending that taxpayers take advantage of the newly updated withholding calculator available on the IRS website to check if too much or too little tax is being withheld from your paycheck.

Those looking to minimize tax liability in 2018 may also want to consider paying off a home equity loan. While interest was deductible on all home equity loans prior to 2018, under the new tax law, if the loan was used to pay off other expenses, the interest will no longer be deductible. However, if the loan was used for home improvements, it’s likely still deductible, provided it falls under the mortgage principle threshold of $750,000.

Aside from lowering your AGI, another area that tax planning traditionally focused on was increasing itemized deductions. While the opportunity to itemize still exists, keep in mind that deductions for moving expenses, alimony (for divorces after December 31st of 2018), and losses from natural disasters that do not occur in federally designated disaster zones have been eliminated, while deductions for state and local taxes paid have been capped at $10,000.

However, the new tax law allows taxpayers to deduct medical expenses that exceed 7.5% of AGI, down from 10% in prior years. If you have a high-deductible health insurance plan, or typically incur significant medical expenses each year, now might be the time to consider using the medical expense deduction. In fact, if you typically have high medical expenses, or a high-deductible health insurance plan, this might be the year to consider opening a Health Savings Account that allows individuals to contribute up to $3,450 annually, while families can contribute up to $6,850.

With all the changes looming for 2018, you may want to contact a finance or tax expert to help guide you through the maze, as well as get you on track for potential tax savings.

1. https://www.thebalance.com/tax-planning-basics-3193487

2. https://www.putnam.com/literature/pdf/II922.pdf

3. https://www.forbes.com/sites/megangorman/2018/03/12/want-to-fund-your-hs...

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any Federal tax penalties. Individuals are encouraged to seek advice from their own tax or legal counsel. Individuals involved in the estate planning process should work with an estate planning team, including their own personal legal or tax counsel. Neither the information presented nor any opinion expressed constitutes a representation by us of a specific investment or the purchase or sale of any securities. Asset allocation and diversification do not ensure a profit or protect against loss in declining markets. This material was developed and produced by Advisor Websites to provide information on a topic that may be of interest. Copyright 2014-2018 Advisor Websites.

*Some IRA’s have contribution limitations and tax consequences for early withdrawals. For complete details, consult your tax advisor or attorney. -Distributions from traditional IRA’s and employer sponsored retirement plans are taxed as ordinary income and, if taken prior to reaching age 59 ½, may be subject to an additional 10% IRS tax penalty.