Financial Planning For Women Who Juggle multiple priorities. Want actionable advice. Prioritize sustainable investments.

The antidote to anxiety is action. I specialize in helping remarkable women like you navigate the complexities of financial planning with confidence and clarity.

As a fiduciary financial advisor, I am required to put my client’s needs ahead of my own. In other words, I will always do what is in your best interest.

Meet Liz Windisch, CFP®

Empowering Women to Take Charge of Their Financial Futures

I help smart women like you take control of their financial destiny. I give you the answers you need by applying data and experience to your goals and dreams. We’ll work together to determine how you can best fund your aspirations, when you can retire, or ways you can support your loved ones. I’ll create and help you execute workable, meaningful financial plans designed just for you. As your trusted partner and financial-health advocate, I ease the burden of your financial decisions and work closely with you to establish and manage your wealth-accumulation strategy.

You’re a woman who already has too much to do and getting your financial life in order keeps getting pushed to the bottom of the list. Isn’t it time to get started building your dream retirement?

Comprehensive Financial Planning for Women

Financial planning is a collaboration

This is who I love working with.

Single Gen X Women

Financial planning looks different when you’re single. Let’s make sure you’re getting the right advice.

LGBTQ+ Women

Work with an ally you look forward to talking to about your plans for the future.

Female Breadwinners

You’re the powerhouse. Work with someone who won’t mansplain your finances.

ESG Investing

Start making a difference with your Investments

Explore the transformative power of ESG (Environmental, Social, and Governance) investing at Aspen Wealth Management. We provide investment opportunities that integrate Environmental, Social, and Governance factors alongside financial performance. ESG investing allows you to align your financial goals with your values, supporting companies that are committed to creating a positive global impact.

Next Steps

3 Things You’ll Need for Our First Meeting

You’ll be surprised at the things you DON’T need for an initial conversation. I don’t need your statements from the last 20 years. What I do need is to know what your dream financial future looks like to you.

01

A list of things that make you happy

We’re talking vision, not spreadsheets.

02

Your $ Goals

Vacation home? Early retirement? Do some fun brainstorming!

03

A willingness to take action

Together we’ll make a plan that makes sense.

Money Insights

Discover Our Latest News And Insights !

When You’re the Back-Up Plan: Financial Tips for Supporting Aging Parents

When we were growing up, none of us thought, “Gosh.…

Why High-Achieving Women Struggle with Doing Nothing (and How to Get Better at It)

Sometimes I have a hard time remembering the last time…

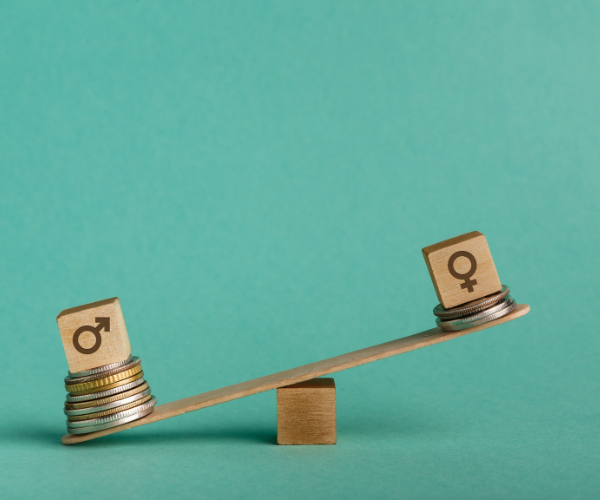

A History of Underpayment: Why ‘Women’s Work’ Still Pays Less

So, you’re a Gen X woman who’s navigated careers, caregiving,…