Financial Planning For Women

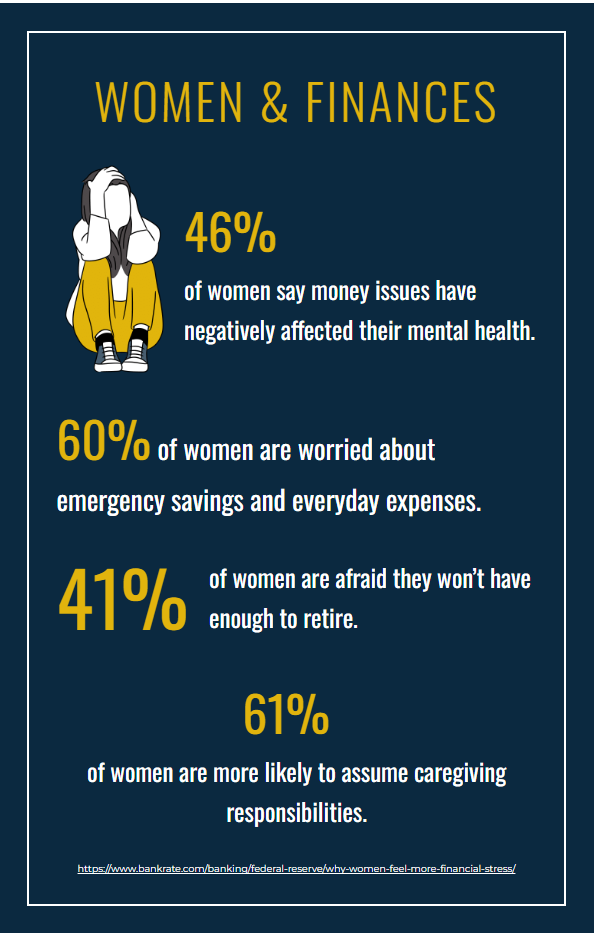

You Might be Stressed About Your Finances . . .

But You Don’t Have to Be.

If you’re like the millions of women laying awake at night worrying about their financial situation, I have good news: You don’t have to be.

Once you find an advisor who can help you understand where you are now and where you’d like to go, you’ll have the answers you need to put an end to the questions rolling around in your head.

You’ve probably heard the term “Comprehensive Financial Planning” but aren’t sure what that means. It means that we’ll look at your entire financial picture to create a custom plan that allows you to live your life today while also planning for the future.

Here are some of the things we’ll tackle together:

- Retirement planning

- Tax strategies

- Estate planning

- Insurance needs

- Understanding employee benefits

Tailored Investment Management

Together we’ll develop an ongoing relationship where you can reach out for support whenever you need it. Whether your goals involve retirement, college funding, or something else, we’ll create a personalized financial plan tailored to your needs.

Once your plan is in place, I’ll recommend an asset allocation strategy designed for your specific goals, select the appropriate investments (with your approval), and take care of managing them so you don't have to worry about daily monitoring.

In addition to managing your investments, I’ll provide guidance on tax optimization, estate planning, and other areas based on your needs. We’ll schedule regular check-in meetings—at least once per year or more often as needed—to ensure your plan stays on track with your evolving financial goals.

What will we talk about?

Our number one goal is to get your questions answered.

This is a safe space for you to talk about your worries and your aspirations. From there we’ll get into more detailed planning and continue to evolve that plan through regular conversations.

Am I on track?

What the heck do I do with these?

Is everything in the right place?

Can we do this without killing each other?

How will this affect my retirement?

Am I doing it right?

Which one should I choose?