When it comes to finances, a lot depends on the financial narratives we tell ourselves. In fact, there are some myths out there that could be holding many of us back (or at least giving us the excuse to not move forward).

I took to LinkedIn and posted a series of polls to see what the feedback would be on some pretty common money assumptions. Here are the results…and here are the answers.

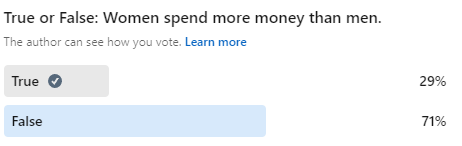

The Answer:

The majority were right!

According to Directions Credit Union, “Single men outspent single women. Men spent an average of $41,203 a year as opposed to $38,838 by women. It’s important to note, though, that the median earning data from the Census Current Population Survey found that overall, women are paid about 17% less than men.”

So, why do some people think that women spend more? The Fem Word had this to say:

“…a lot of it has to do with popular media. Movies have long depicted female “shopaholics” as main or major characters. The archetypal “rich girl” or heiress is also ubiquitous in Hollywood, and jet-setting celebrities such as the Kardashian sisters or Paris Hilton have only reinforced the image in our popular imagination.”

In other words, don’t believe everything you see in the media. And keep working on getting that pay raise.

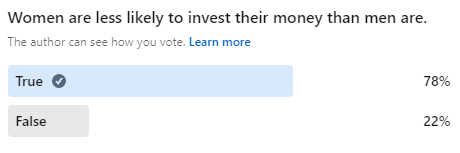

The Answer:

The majority got it right again!

Unfortunately, this statistic is true. “While more than half of Americans (56%) say they currently invest in the stock market, this is only true for 48% of women, compared to 66% of men, according to a new NerdWallet survey.”

HOWEVER, it’s important to note that according to Fidelity’s 2021 Women and Investing Study, women’s returns were 0.4% higher than men’s.

Another interesting statistic from the same study: Eighty-six percent of women agree that having their investments managed by professionals makes life less stressful.

Bottom line: Get started, take control of your finances, and ask a professional to help.

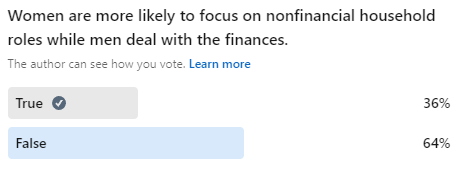

The Answer:

This one was interesting because “nonfinancial household roles” can have a big impact on family finances.

According to the Federal Reserve…

Marketing polls and survey data indicate that American women have a large role in consumption decisions undertaken by the typical household in today’s consumer markets. As household managers, women supervise the budget for and purchase of many of the highest-cost items consumed by American families. These items include food, clothing, childcare, eldercare, health care, transportation, family communication networks (including cell phone and computer purchases), vacations, and, finally, financial services and products.

One recent market survey reports that women account for 80 percent of all consumer purchasing decisions, making 93 percent of food purchases and 65 percent of auto purchases, for example.6 Because women engage in more of the family shopping, they are more consistently aware of price changes and inflation. Women running households know just what it takes to make the budget stretch and how to navigate changing market prices, and they are engaged in more financial and consumer decision-making than at any other time in our social history.

In other words, as most women still take on primary caregiving duties (along with a ton of other stuff), they’re pretty much running the financial show at home as well.

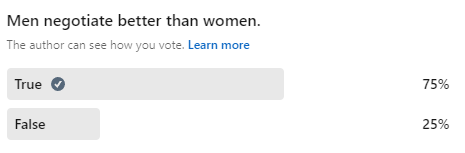

The Answer:

Sorry, majority. This one is FALSE. It just feels true. And here’s why:

New research by Berkeley Haas Professor Laura Kray shows the belief that women don’t ask for higher pay is not only outdated, but it may be hurting pay equity efforts. Contrary to popular belief, professional women now report negotiating their salaries more often than men, but they get turned down more often, Kray found.

“While men in the past may have been more likely than women to negotiate, the gender difference has since reversed,” says Kray, the Ned and Carol Spieker Chair in Leadership. “Continuing to put the blame on women for not negotiating away the gender pay gap does double damage, perpetuating gender stereotypes and weakening efforts to fight them.

If people believe men have better outcomes simply because they negotiate and women don’t, then they think we just need to train women to negotiate better rather than fixing a discriminatory system,” Kray says. “We call this a ‘legitimizing myth.’”

Let’s just call this what it is: it’s victim shaming. The narrative is that women don’t negotiate as well as men, when the truth is that it’s the system that’s stacked against us. Yes, we’re slowly seeing change, but it can’t come soon enough.

Keep asking for those raises.

What We’ve Learned

When it comes to limiting beliefs about money, a lot of them are ingrained in us because of what society tells us. We have been groomed to believe that we’re not as savvy and we don’t have the same skills as men when in reality women wear so many hats…why WOULDN’T we be better with money than men?

It’s all about overcoming those stereotypes and not giving false narratives the attention they want. Invest, budget, and negotiate and you’ll likely get the outcome you’re looking for.

Ready to be one of those 86% of women who are less stressed because they work with an advisor? Let’s talk.