There is constant buzz out in the world about legacy planning:

- How much do you want to leave your heirs

- How you should do it so they don’t get slammed with taxes

- How can you set up your estate plan in a way that they spend the inheritance responsibly?

However, there’s less talk about this topic: what if you don’t want to leave an inheritance at all??

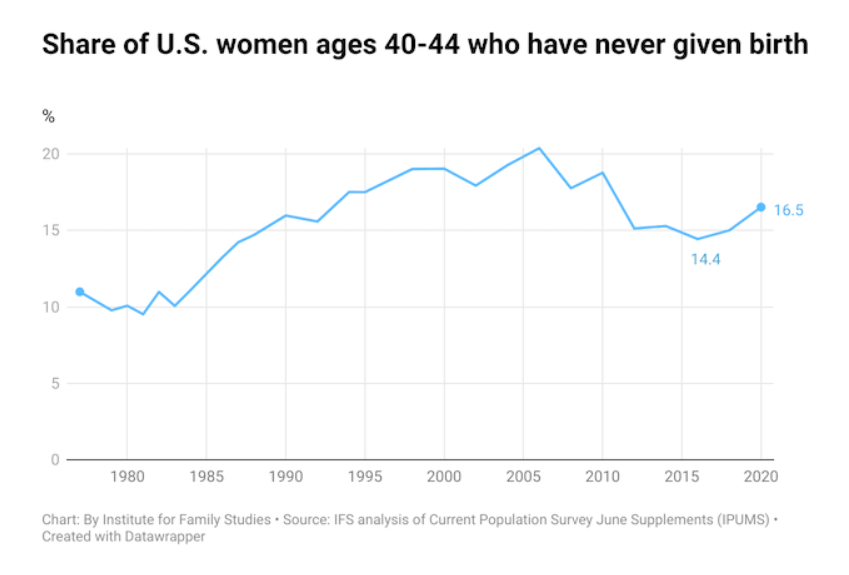

The number of women not having children is on the rise. According to the Institute for Family Studies, “More U.S. women are skipping motherhood today. In 2020, 1-in-6 women reaching the end of their childbearing years had never given birth, according to a new Institute for Family Studies analysis of Census data. This share was lower in 2016, when 14% of women ages 40 to 44 had never given birth. At the same time, the share of women who have had two or more children declined from 32% in 2016 to 30% in 2020.”

In my blog, we try to tap into the many questions that single Gen X women have about money. So, it makes sense to talk about this elephant in the room.

Whether you don’t have children by choice or by circumstance, you might be wondering how to handle your finances if leaving a legacy isn’t a consideration. So, let’s talk about that.

I want my bank balance to come out at $0 when I die. I don’t want to leave anything behind.

I often joke with my clients that if they can tell me exactly how long they will live, I can tell them how much money they can spend. Since that is not an option (if you CAN do this – call me!!) it is difficult to find the balance between running out of money and not leaving a lot of money behind.

A financial advisor can help run the advanced calculations necessary to get close. However, if you make sure that you don’t run out of money, you will absolutely have money “left over.” The safest option is to get close to spending all of your money and have an estate plan that honors your wishes with the money you leave behind.

One option that few people consider is gifting money while you are alive vs. leaving it to heirs after you pass. You still won’t know how exactly how much is safe to give away, but the older you are, the easier it is to know if you have excess funds. We in the biz like to call that “giving with warm hands instead of cold.” A bit morbid, but it can be so rewarding to help while you are alive to see the impact your money is making.

If I do have some money available after I’m gone, what are my options? How can I make sure the cousin I hate doesn’t get it?

Making sure your money is left to the heirs or charity that you would like depends on what kind of asset it is. Retirement accounts allow you to designate beneficiaries. This choice supersedes a will or trust, so it is very important to keep these up to date. Non-retirement accounts have a similar option, and you should discuss this with your advisor or bank representative. Assets such as a house or personal property can be designated through a will or trust, and this should be done with an estate planning attorney who is licensed in your state.

What do I need to do if I change my mind? Who do I talk to about that?

Speak with your financial advisor, bank representative, and/or your estate planning attorney. Once you have established your estate plan, changes generally should not be too difficult to make.

Ultimately, the choices you make about your money should be discussed with a financial planning professional. We understand that your decisions are personal and they’re YOURS. We’re here to listen to your needs, values, and goals so that we can help you make the right choices for your individual situation. So, if you’re ready to run the numbers, I’m here to help you. CLICK HERE to make an appointment.